How to Buy, Sell & Pawn Gold in Thailand

In Thailand, buying and selling gold at a Thai gold shop is a common investment strategy. It also is a way that Thai people save money so as to avoid the temptation of emptying their bank account. In this post, we will cover everything a foreigner needs to know about buying, selling, and pawning gold in Thailand, so that you can feel confident should you ever want to do it.

Types of Gold in Thailand

There two most common types of gold found in Thailand gold shops are:

1) 99.9% gold (24K). This is almost 100% pure gold and quite soft. Due to its softness, it is rarely used in the making of Thai gold jewelry. It is sometimes used to make gold bars in Thailand, with the bars being weighed in grams. However, only a small percentage of gold bars are made with 24K gold.

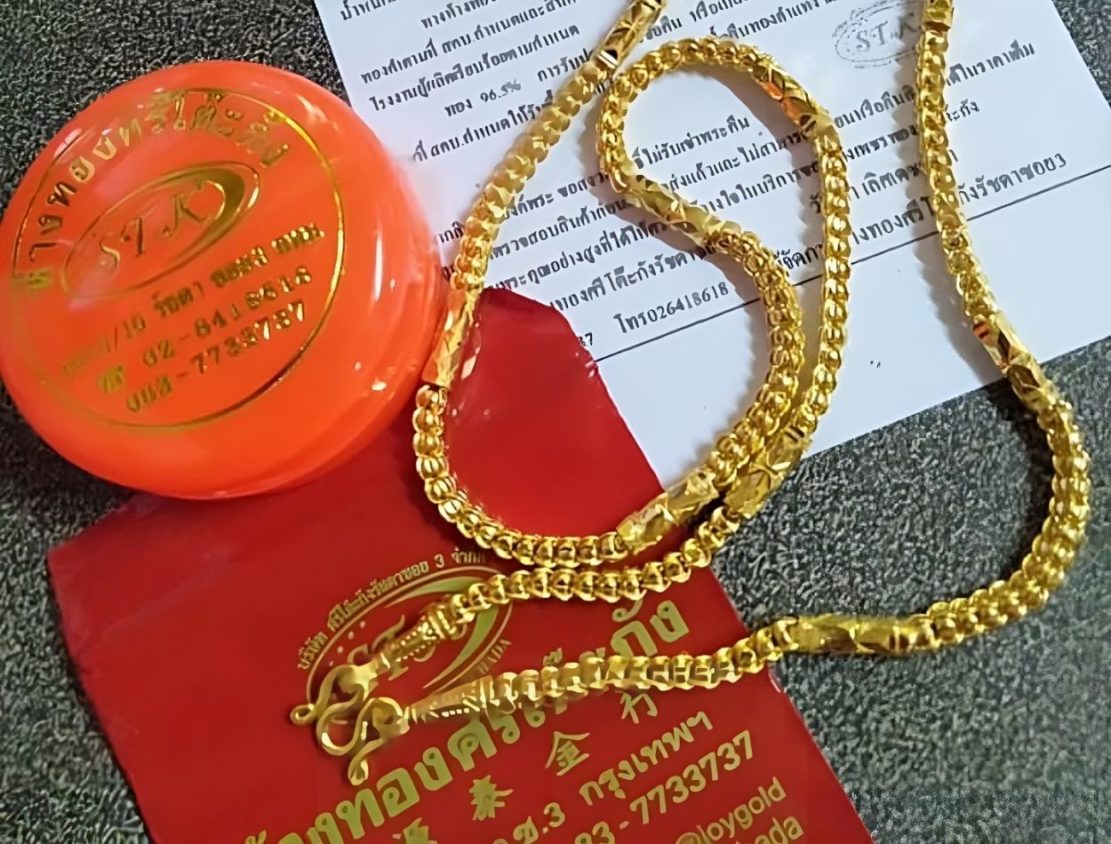

2) 96.5% gold (23K). This is the standard gold used to make gold bars in Thailand, and the most common type of gold that you’ll see in gold shops. It’s also used to make Thai gold jewelry bought for investment purposes, such as gold necklaces, bracelets, gold rings, gold pendants, etc. This gold is still quite soft and isn’t the kind of gold used to make gold jewelry set with gems. Gemstone jewelry in Thailand is usually set with 18K or 14K gold, and ordinarily not the type of jewelry that you’ll find sold in Thai gold shops. Although some shops do sell a small amount of gemstone jewelry, such as large colored gemstone rings.

The gold percentage will be stamped in the gold bar and gold jewelry, so be sure to look for that gold stamp before purchasing the item.

Gold bars and jewelry are manufactured in Thailand by weight in baht (15.244 grams) and salung (3.81 grams). Do not confuse the word “baht,” which refers to the weight of gold, with the Thai word “baht” that refers to a unit of money. Although these two words are spelled identically (baht – บาท), they refer to two different things.

The Selling Price of Gold at Thai Gold Shops

Thai gold shops are called “raan thawng” (ร้านทอง). They advertise two prices: the selling price (ราคาขาย) and the buy back price (ราคารับซื้อ). For gold bars, the selling price will be approx. 100-400 baht per gold baht above the buy back price, and approx. 940 – 1,600 baht per gold baht above the buy back price for gold jewelry.

The selling price for gold bars and jewelry is figured out by first taking that day’s gold trading price (as listed by Thailand’s Gold Traders Association), applying to the weight of your item, and then adding additional fees that cover the manufacturing and processing costs. These fees and markups are much lower that what you would find in a jewelry store, which is why you can buy and sell gold jewelry as an investment in Thailand gold shops.

For example, the fee that is added to that day’s gold trading price could be as little as 500 baht for a 1 baht gold bar or 1 baht gold bracelet. The fees will be higher if the gold bar is engraved with an intricate logo or the gold jewelry is manufactured in a fancy design.

Note that gold shops in Thailand are highly regulated by the government and very competitive, so it is highly unlikely that you’ll ever be misled or cheated when buying or selling with a Thai gold shop.

The Buy Back Price at Gold Shops in Thailand

If you are selling the gold jewelry or bar that you bought at a gold shop in Thailand, you will usually get the highest price by selling your item back to the store where you bought it. This is because that store can legally discount the current “buy back” price only by 1.8-5%, while another gold shop could (and often does) discount the current “buy-back” price by over 5% (discount means less money payed to you).

The Best Thai Gold Shop

It is kind of hard for us to say who is the best Thai gold shop, because there are so many. However, what we can say is who the largest gold shop in Thailand is, and thus the most convenient one to buy and sell gold at (wherever you live in Thailand).

Yaowarat Gold Shop (ร้านทองหุ้มเยาวราช) has has been operating for over 50 years, since 1969. They have the largest network of gold shops in Thailand, with more than 300 branches. If you buy gold at one branch, you can resell it at another branch and it is considered the same store. Thus they must follow the 1.8-5% discount buy back rate, which is often closer to the 1.8% minimum set by the Gold Traders Association of Thailand, of which Yaowarat is a member. In Sakon Nakhon, there is a Yaowarat Gold Shop at the Robinson’s Lifestyle Mall. You’ll often find other branches at Robinson’s malls throughout Thailand.

Pawning Gold in Thailand

Just like the Thai gold shop industry, the pawn shop industry in Thailand is highly regulated and supervised. Not only that, some Thai pawn shops are actually run by the government, ensuring that the interest rates are not exploitative. Not surprisingly, Thais often will pawn gold for a short term loan, just as they frequently buy gold as an investment.

Interest rates at government-operated pawnshops in Thailand are currently .25% – 1.25% per month, divided into the following stages:

– For a principal not exceeding 5,000 baht, the interest rate is 0.25 percent per month.

– For a principal of 5,001 – 10,000 baht, the interest rate is 0.75 percent per month.

– For a principal of 10,001 – 20,000 baht, the interest rate is 1.00 percent per month.

– For a principal of 20,001 – 100,000 baht, the interest rate is 1.25 percent per month.

Interest rates at private pawn shops in Thailand are ordinarily higher. For example, it is not uncommon for a private pawnshop to have 2% interest fee on your first 2,000 baht and any amount over that be given a 1.25% interest fee.

So, let’s say you pawn 40,000 baht worth of gold at a private Thai pawn shop which uses the above interest plan. You will pay interest per month as follows: 2000 baht x 2% = 40 baht. For the excess: 38,000 baht x 1.25% = 475 baht. Total interest to be paid is 40 + 475 = 515 baht per month.

- Monogamy and the Mia Noi in Thailand - April 27, 2024

- How to Greet a Monk in Thailand – Saying Hello - April 22, 2024

- Hottest Place in Thailand – Record High Temperature 2024 - April 22, 2024